India’s renewable energy journey has long been defined by capacity additions, competitive tariffs, and ambitious national targets. As the country advances towards its 500 GW non-fossil fuel capacity goal by 2030, the focus is gradually shifting—from merely adding renewable capacity to ensuring credible, compliant consumption of clean energy.

It is in this context that the Central Electricity Regulatory Commission (CERC) issued its Guidelines for Virtual Power Purchase Agreements (VPPAs) on 24 December 2025. While the announcement did not dominate headlines, it represents a meaningful inflection point in India’s renewable procurement and compliance framework.

But first let’s understand

What Is a Virtual Power Purchase Agreement (VPPA)?

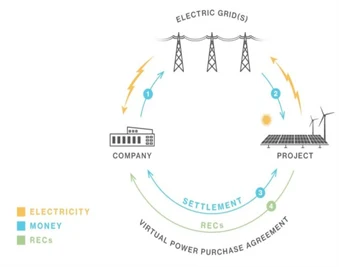

A Virtual Power Purchase Agreement is a financial contract between a corporate buyer and a renewable energy developer. Unlike a traditional or physical PPA, electricity generated under a VPPA is not delivered to the buyer’s facilities.

- The renewable project sells electricity into the wholesale power market.

- The corporate buyer agrees on a fixed “strike price” for the power.

- The difference between the market price and the strike price is financially settled between the two parties.

- The buyer receives the environmental attributes of the project in the form of Renewable Energy Certificates (RECs or I-RECs).

Source: COHO

In essence, a VPPA allows corporates to decouple renewable energy procurement from physical electricity consumption, making it a powerful tool for companies with dispersed or international operations.

How Does a VPPA Work?

At its core, a Virtual Power Purchase Agreement functions as a financial hedge rather than a physical power supply contract. VPPA is structured as a long-term agreement where the corporate buyer and the renewable energy developer agree on a fixed price for electricity, while the actual power is sold into the wholesale market. The contract then financially settles the difference between this agreed price and the market price, allowing both parties to manage price risk while enabling the corporate buyer to claim the environmental benefits of renewable generation.

Here’s how it works in practice:

- A solar or wind project generates renewable electricity and sells it into the power market at the prevailing market price.

- The corporate buyer and the developer agree on a fixed strike price under the VPPA.

- If the market price is higher than the strike price, the developer pays the difference to the buyer.

- If the market price is lower than the strike price, the buyer pays the difference to the developer.

- Separately, the renewable energy certificates generated by the project are transferred to the buyer.

This structure provides revenue certainty to developers while offering corporates long-term price hedging and sustainability benefits.

VPPA vs Physical PPA: What’s the Difference?

Both physical PPAs and VPPAs support renewable energy development, but they serve different corporate needs.

Source: KYOS

- A physical PPA involves direct delivery of electricity to a specific facility.

- A VPPA is purely financial and does not require grid connectivity between the generator and the buyer.

Physical PPAs work best for single-location or regionally concentrated loads. VPPAs, on the other hand, are better suited for companies with geographically dispersed operations or multiple consumption points

Role of RECs and I-RECs in a VPPA

Since electricity is not physically consumed, renewable energy certificates are central to a VPPA’s value.

- Each REC or I-REC represents the environmental attribute of 1 MWh of renewable electricity.

- In a VPPA, these certificates are contractually assigned to the corporate buyer.

- The buyer can then make credible renewable electricity claims under global reporting frameworks.

For multinational companies operating across borders, I-RECs ensure consistency, traceability, and compliance with international sustainability standards.

Role of RECs and I-RECs in a VPPA

While VPPAs offer flexibility, they also come with considerations that corporates must evaluate carefully:

- Market price volatility impacting settlement outcomes

- Long-term contractual commitments (often 10–15 years)

- Accounting and treasury implications

- Regulatory clarity, especially in developing markets

- Counterparty risk requiring strong project due diligence

Successful VPPA implementation depends heavily on robust contract structuring, market expertise, and risk management.

VPPAs in the Indian Context

In India, Virtual Power Purchase Agreements are gaining relevance as renewable energy policy shifts from capacity addition to credible consumption and compliance. With the introduction of Renewable Consumption Obligations (RCO) for large electricity consumers, corporates are looking for flexible ways to meet clean energy requirements beyond physical PPAs and short-term REC purchases.

The Central `Electricity Regulatory Commission (CERC) guidelines issued in December 2025 provide the regulatory clarity needed to enable VPPAs as a legitimate procurement and compliance mechanism. By formally recognising VPPAs as non-physical, bilateral contracts linked to REC transfer, the framework creates a new pathway for corporates to align regulatory obligations with market-based renewable sourcing—without operational complexity.

At Fourth Partner Energy, we work with corporates to understand their exact clean energy requirements and customise our solutions accordingly. If your business is exploring VPPAs as a tool to Net Zero, reach out to our marketing team today.